Calculate my roth ira

Because this is a Roth IRA. This decision has tax implications which can be relevant to calculating.

Roth Ira Calculators

Net income Excess contribution x ACB AOB AOB Where.

. Ad Explore Schwabs Infographic To Understand IRA Differences And Contribution Limits. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. One concern is whether your 401k or IRA is a Roth account or a traditional account.

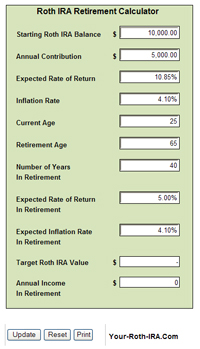

Refine Your Retirement Strategy with Innovative Tools and Calculators. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Calculate your earnings and more.

For 2022 the Roth IRA income limits for a full IRA contribution is 125000 for singles and heads of household 204000 for married couples. As of January 2006 there is a new type of 401 k -- the Roth 401 k. Open An Account That Fits Your Retirement Needs With Merrill.

The online Roth IRA Calculator is an easy and free way to calculate the estimated future value of your Roth IRA. Your IRA could decrease 2138 with a Roth. For comparison purposes Roth IRA.

This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your Traditional IRA into a Roth IRA. For 2022 the maximum annual IRA. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

For the purposes of this calculator we assume that your income does not limit your ability to contribute to a Roth IRA. Traditional and Roth IRAs give you options for managing taxes on your retirement investments. All you need to begin is your current Roth IRA.

Ad Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. Open An Account That Fits Your Retirement Needs With Merrill. Starting in 2010 high income.

Reviews Trusted by Over 45000000. Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

For instance if you expect your income level to be lower in a particular year but increase again in later years. Ad Set Your Goals and Invest Your Way With A Merrill Retirement Account. Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now but withdraw the funds tax-free in retirement.

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. ACB is the adjusted opening balance which equals the prior months Roth IRA balance plus all contributions made to the. Calculate your earnings and more.

Roth IRA Income Limits 2022. Compare 2022s Best Gold IRAs from Top Providers. A 401 k can be an effective retirement tool.

Unlike taxable investment accounts you cant put an. Ad Set Your Goals and Invest Your Way With A Merrill Retirement Account. It is mainly intended for use by US.

Converting to a Roth IRA may ultimately help you save money on income taxes. The Roth 401 k allows contributions to. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance.

Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRAs ie traditional. If you have an annual salary of 100000 and contribute 6 your contribution will be 6000 and your employers 50 match will be 3000 6000 x 50 for a total of 9000.

The amount you will contribute to your Roth IRA each year. Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

This calculator assumes that you make your contribution at the beginning of each year. While long-term savings in a Roth IRA may. 8 rows The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in.

Roth Ira Calculators

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Roth Ira Calculator Roth Ira Contribution

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator How Much Could My Roth Ira Be Worth

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management